An Unbiased View of Home Buyers Insurance

Home Buyers Insurance Things To Know Before You Get This

Table of ContentsThe 10-Second Trick For Home Buyers InsuranceOur Home Buyers Insurance StatementsHow Home Buyers Insurance can Save You Time, Stress, and Money.More About Home Buyers InsuranceAn Unbiased View of Home Buyers InsuranceHome Buyers Insurance Can Be Fun For EveryoneExcitement About Home Buyers InsuranceNot known Factual Statements About Home Buyers Insurance Some Ideas on Home Buyers Insurance You Should Know

When it concerns exactly how you recover water, wells can likewise be shielded with insurance coverage on all parts of the well pump, offered the well is the key water source to the residence. Not all residences are built in a "cookie cutter" design, as well as Select Residence Warranty permits property owners to acquire the supreme satisfaction with complete insurance coverage.Give us a call today:.

Not known Factual Statements About Home Buyers Insurance

In this write-up, we'll discover what a home warranty is, what it covers, as well as what benefits home service warranty protection can provide to property owners., which uses three degrees of coverage, plus add-on alternatives, at an affordable price.

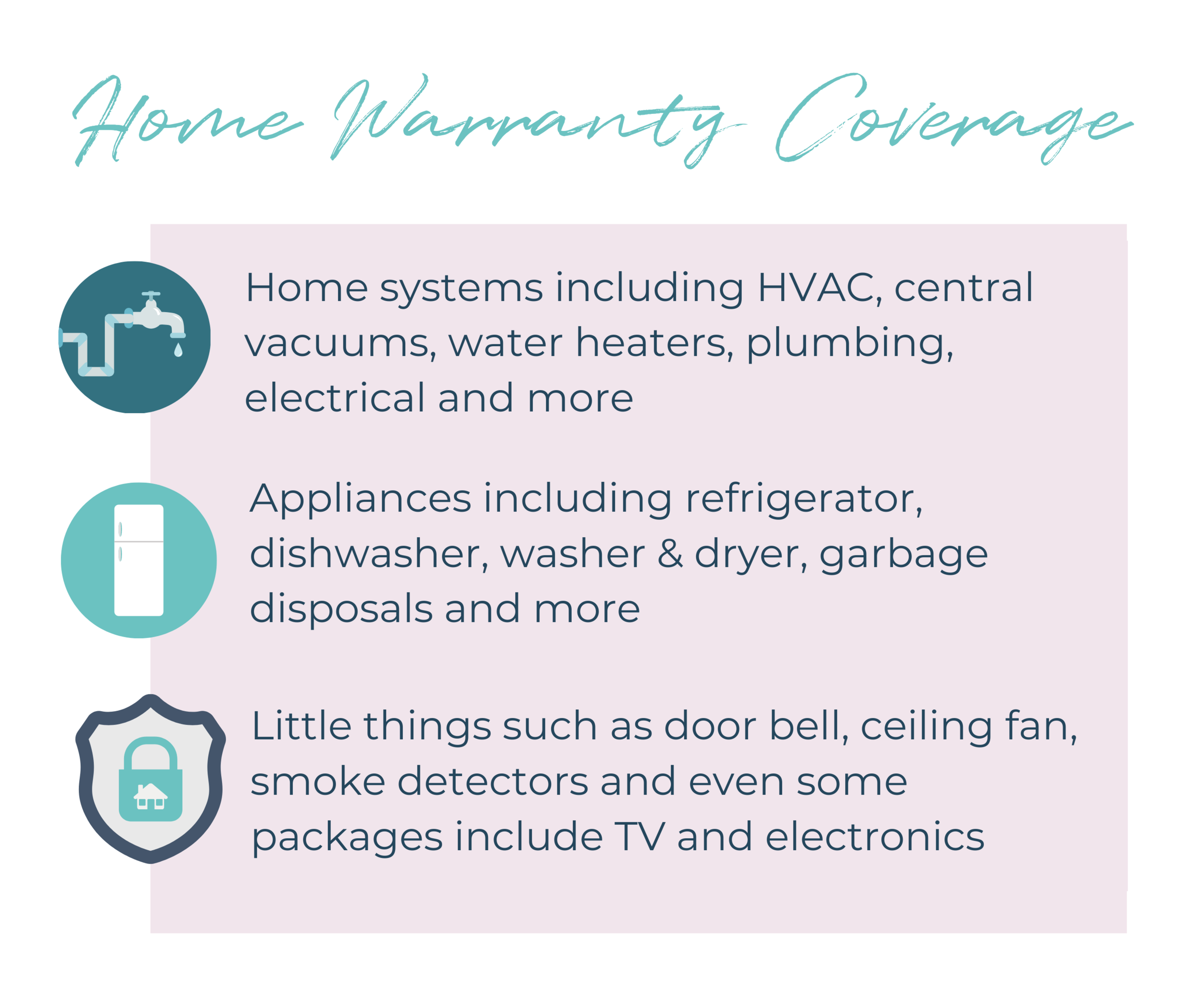

What Does A Home Service Warranty Cover? Specifically what's covered by a home guarantee varies relying on the house guarantee business that you use and also the guarantee plan you register for. Normally, a home warranty covers the significant systems and appliances in your house. If you consider the devices and systems you could not do without, you would certainly have a typical listing of things covered by a home warranty: Furnace, Cooling, Electric system, Pipes system, Fridge, Stove/cooktop/oven, Dishwashing machine, Garments washing machine, Clothes dryer Nonetheless, different warranty firms supply a variety of strategy variants.

The 6-Second Trick For Home Buyers Insurance

Prior to you sign up for a policy, it is essential to check out the example agreement and to make sure you understand what is covered and also what isn't. It's typical for a house service warranty to omit appliances that were poorly set up as well as products that haven't been properly maintained (home buyers insurance). If you're buying a home, it makes feeling to get a residence assessment so you understand the condition of the systems and devices prior to you attempt to buy a home service warranty.

Once more, these restrictions will be covered in the example agreement, so read it carefully. When Do You Need A Residence Service Warranty? A residence service warranty is a great concept whenever you have devices and also systems that are out of the manufacturer's warranty. home buyers insurance. If your appliance breaks, you just call the house warranty firm, as well as the repair must be looked after.

Home Buyers Insurance - Truths

They might have made use of most of their cost savings to come up with the down payment, so a house service warranty gives an economic cushion for home repair expenses. Numerous residence warranties do not omit appliances or systems because of age.

The Buzz on Home Buyers Insurance

Your residence might be a lot more attractive to buyers since it offers them check here comfort to recognize that fixings will certainly be covered if anything quits functioning after shutting. If you purchase a new building home, the devices and also systems will be under manufacturer's warranty for a year or 2. A residence service warranty won't cover things covered by the supplier's guarantee, so consider acquiring a house guarantee after the warranties your house featured run out.

Indicators on Home Buyers Insurance You Should Know

Home Insurance House insurance covers your home for damages that occurs in a disaster or all-natural disaster, such as a fire or hailstorm. It doesn't cover a device or house system that gets on the fritz since it's old as well as starting to break. In those (the good news is) uncommon instances where your kitchen devices obtain fried by a lightning strike, you may be able to make a claim on your property owner's insurance coverage policy.

The cost of a service charge varies by the residence service warranty firm, and some business bill a reduced yearly cost if you accept a higher service fee. Various other factors that impact the price of a house guarantee consist of: Geographic place. Residents in areas with a greater expense of living may pay more due to the fact that it sets you back a lot more for the guarantee company to carry out fixings.

The Only Guide for Home Buyers Insurance

You might save cash by paying your yearly fee in one swelling sum or by paying even more than one year's premium at once, instead of paying monthly. Expense Benefits Of A Home Guarantee With a home guarantee, you know you won't have to pay full price to repair or replace covered devices and systems.

If you paid $350 for your residence guarantee and $100 for the solution call, you're still in advance by almost $100 versus spending for an ordinary water heater repair of $546 without a warranty. If you require two or even more solution contact a year for different devices which is completely likely with an click this old house you 'd conserve also much more.

Home Buyers Insurance Things To Know Before You Get This

If there is a $1,500 limit visit this web-site under your home service warranty strategy for air conditioning repair service or replacement, then any type of price over $1,500 is your duty. Still, that's $1,500 less you need to take out of your bank account when the ac unit passes away. Our Suggestion For House Guarantee Defense Based upon our research study of the major gamers in the residence guarantee space, we advise American Home Guard.

To get a cost-free quote from our top choice, make use of the get in touch with information listed below:.

Indicators on Home Buyers Insurance You Need To Know

Home warranties have become far more common over the previous few years. Much of this development has been fueled by the realty market, as vendors are commonly encouraged to give a home warranty as a tool to tempt purchasers. Furthermore, purchasers will frequently ask sellers to include a home warranty when negotiating the sales agreement.